For v1 documentation refer to Electronic Invoicing API Docs

1. Introduction

|

Aruba’s Electronic Invoicing Web Services are available to Premium users or basic users connected to them by proxy. |

"Electronic invoicing" is the digital process of generating and managing invoices throughout their whole life cycle:

-

generating

-

sending/receiving

-

compliant storage

Electronic invoice refers to:

-

a digital document

-

structured in accordance with a standard language, in other words, tracked "PA invoice" .xml format

-

digitally signed by the issuer (for PAs)

-

with the minimum mandatory content stipulated by Ministerial Decree 55/2013 (Annex A)

-

to be stored in accordance with the relevant regulations (pursuant to the Prime Ministerial Decree of 3 December 2013) compulsorily both for tax purposes (Ministry of the Economy and Finance Decree of 17 June 2014) and for statutory accounting periods (Art. 2220 of the Italian Civil Code).

Those involved in the Electronic Invoicing process are:

-

The Economic Operator (EO): the transferor/provider that issues the invoice to the PA/PRIVATE INDIVIDUALS or the transferee/client that receives electronic invoices

-

The Intermediary (Aruba PEC S.p.A): the party appointed by the transferor/provider or the transferee/client to send and/or receive electronic invoices sent via the SDI on their behalf

-

Exchange System (Sistema di Interscambio, SDI): system under the control of the Ministry of the Economy and Finance, via which electronic invoices are sent to the Administration (art. 1, paragraph 211, law no. 244 of 24 December 2007) or to private individuals (art. 1, paragraph 2, legislative decree 127/2015)

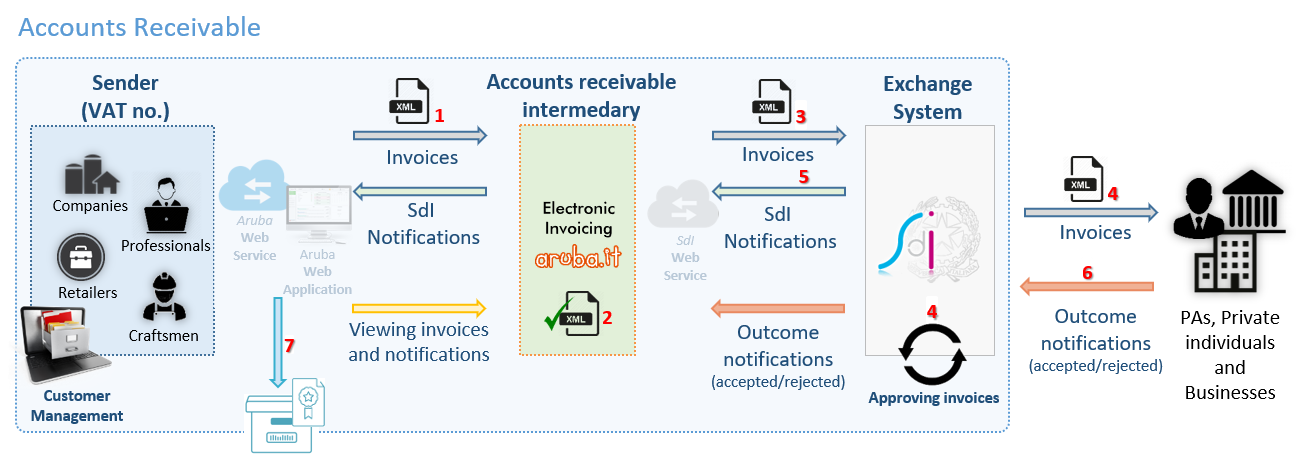

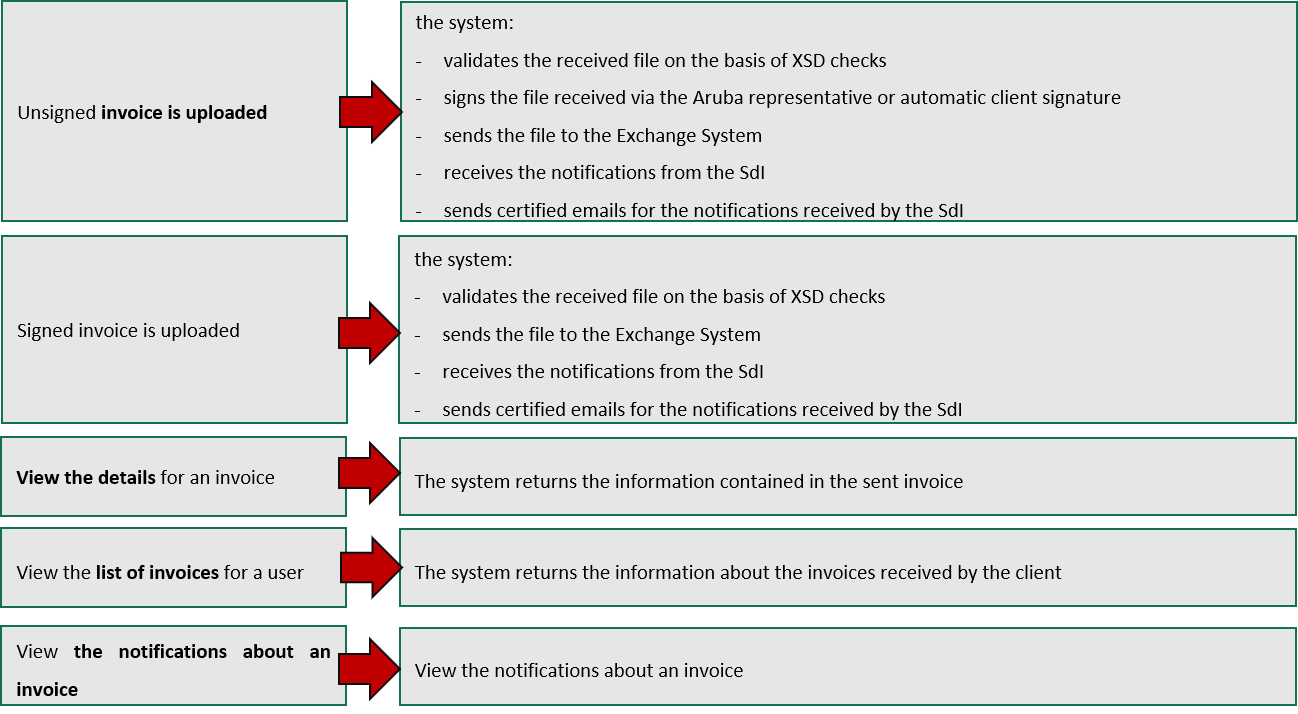

The processes for sending (accounts receivable) and receiving (accounts payable) electronic invoices via Aruba’s Electronic Invoicing system are outlined in the figures below:

-

The Economic Operator creates the invoice as an .xml file (from its own management system or the Control Panel) and sends the invoice via web service channels.

-

Aruba PEC (the intermediary) makes sure that the format is compliant

-

Aruba PEC adds the qualified electronic signature (optional for B2B and B2C) via an automatic Aruba PEC or Client signature and sends it to the SDI.

-

The SDI checks and approves the electronic invoice and sends it to the recipient (using the recipient code or PEC) or to a third party recipient used by the recipient

-

The SDI sends Aruba PEC S.p.A. a notification explaining that the invoice has been rejected, not delivered or delivered.

-

Once the notifications have been received confirming the outcome of the sending process (accepted/rejected) from the recipient, the SDI sends them to Aruba PEC S.p.A. (exchange not provided for B2b and B2C), which delivers them to the EO.

-

Sent invoices digitally stored in accordance with regulations (mandatory).

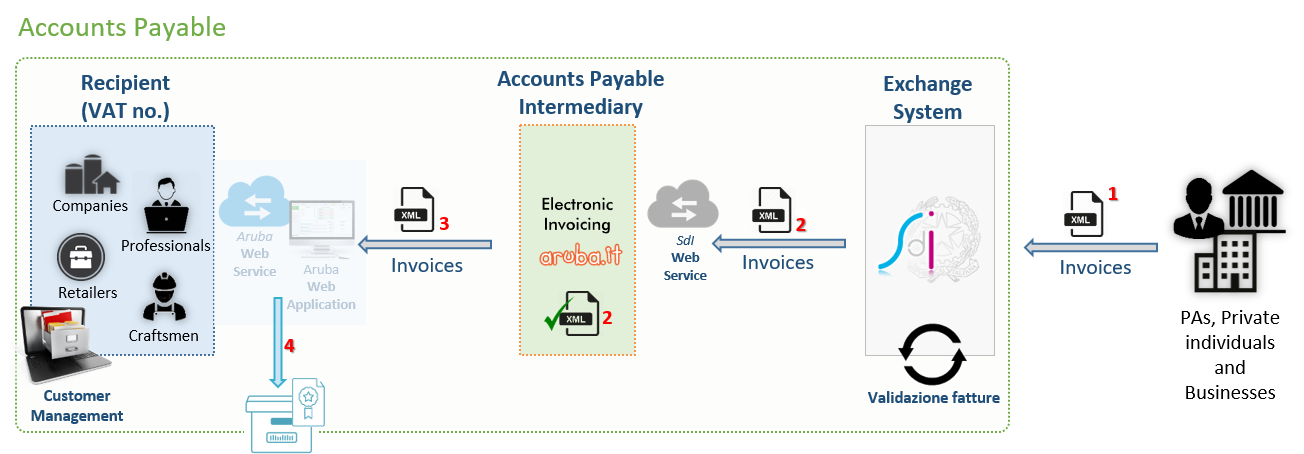

-

The Economic Operator or its intermediary sends the electronic invoice to the Exchange System using the seven-character recipient code for Aruba PEC (receiving intermediary), provided by the Exchange System.

-

The SDI sends the invoice received from the sender to the Aruba PEC receipt channel (linked to the recipient code)

-

Aruba PEC delivers the electronic invoice received to the Client according to the VAT number via WS, web application and/or PEC

-

Aruba PEC stores the electronic invoices sent in accordance with the regulations via the compliant DocFly Digital Storage system

In order to receive electronic invoices via Aruba’s Electronic Invoicing system, they need to be sent to the recipient code KRRH6B9.

The Recipient Code is a unique 7-digit code issued by the Italian Revenue Agency to owners of a channel for receiving electronic invoices via the Exchange System (SDI). So this code is issued either to the VAT numbers for parties accredited by the Italian Revenue Agency, or to accredited intermediaries responsible for handling invoices to recipients (such as Aruba).

| Aruba’s recipient code, which is required in order to receive electronic invoices via the Electronic Invoicing application, is: KRRH6B9. |

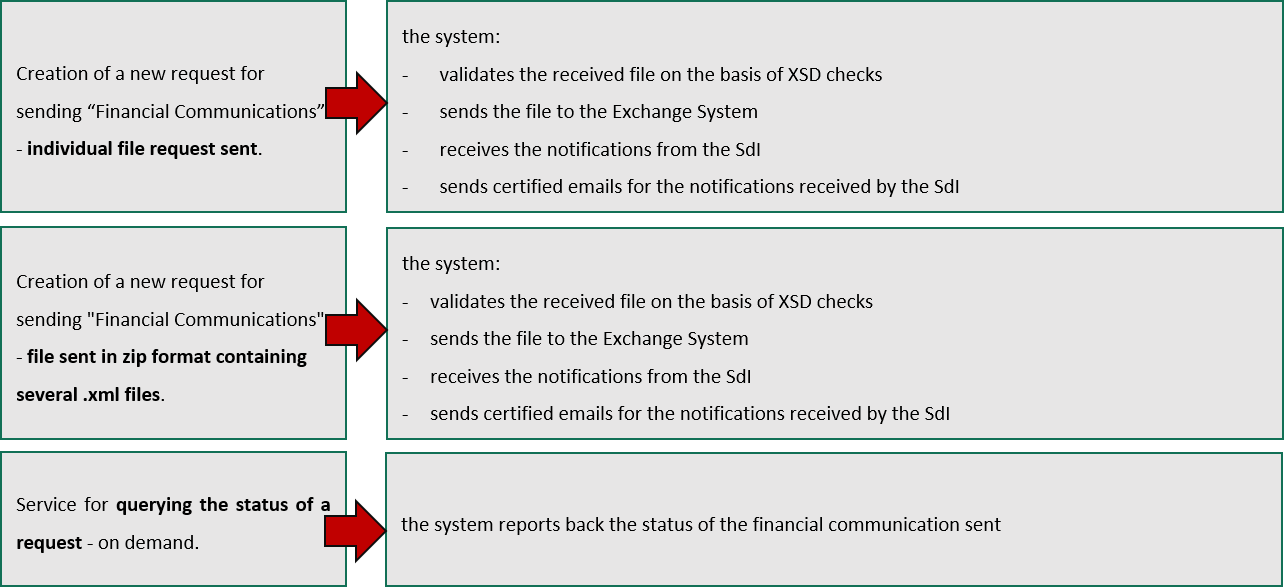

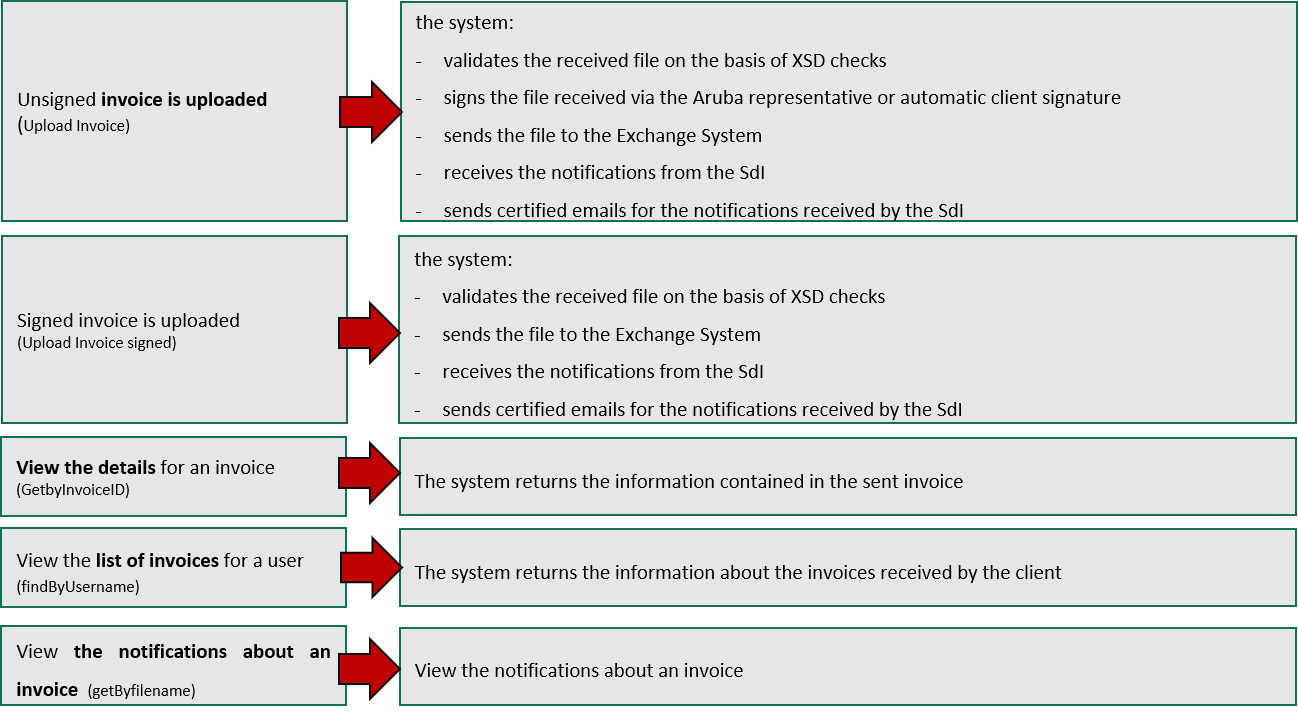

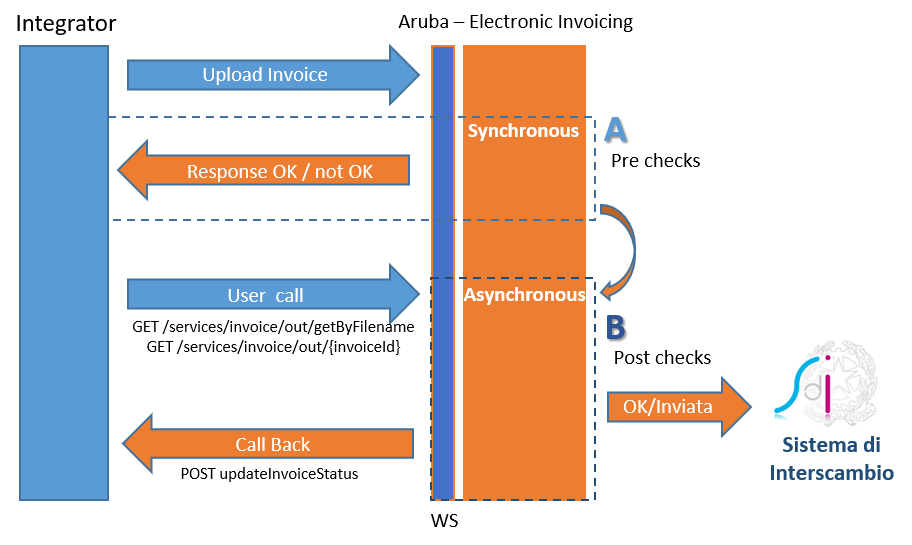

This guide explains how to use the web services offered by Aruba’s Electronic Invoicing system properly. Aruba’s Electronic Invoicing system offers a series of REST APIs with which you can interface to send invoices to the SDI, find for sent and received invoices, as well as send financial communications about the "new spesometro" (regular VAT payments and Invoice data).

The system can also send received invoices (accounts payable) from Web Services shown by the user, which will have to implement a series of technical and functional requirements.

The system deals with requests received via the services, processes them, checks certain data and sends them to the SDI (Exchange System).

SDI processes the requests by running checks on the data sent and, in the case of Financial Communications, generates a result that the Aruba system verifies and notifies its customers accordingly.

In the case of an electronic invoice, SDI processes the data received, transmits it to the Public Administration or Private entities and notifies the ARUBA system directly of the results.

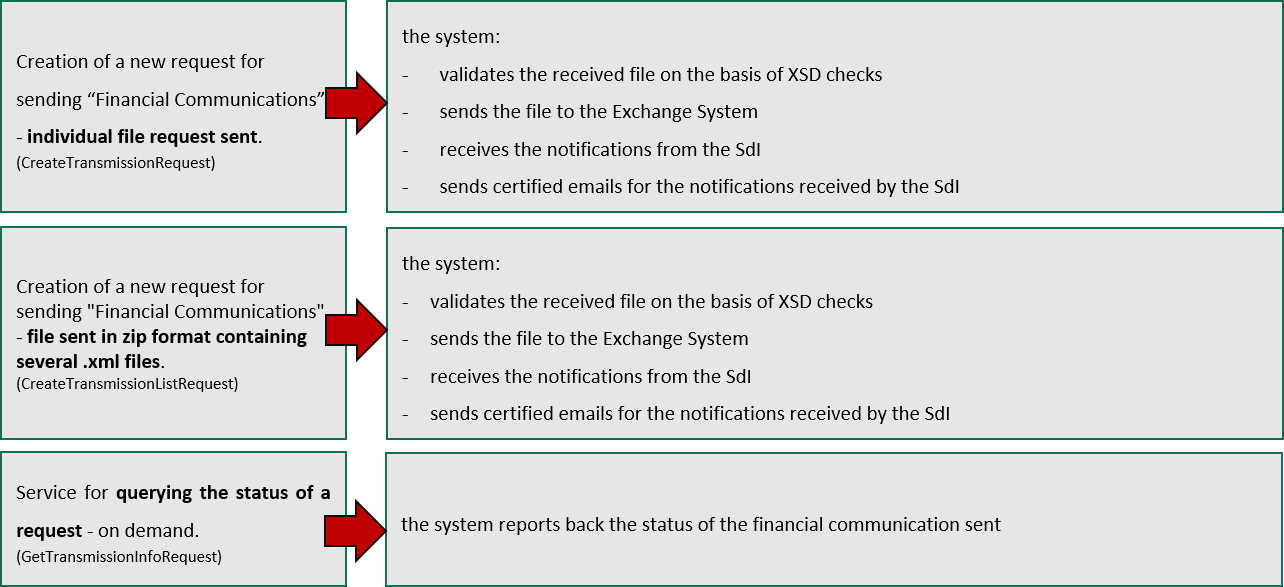

The web services shown allow you to provide Financial Communications:

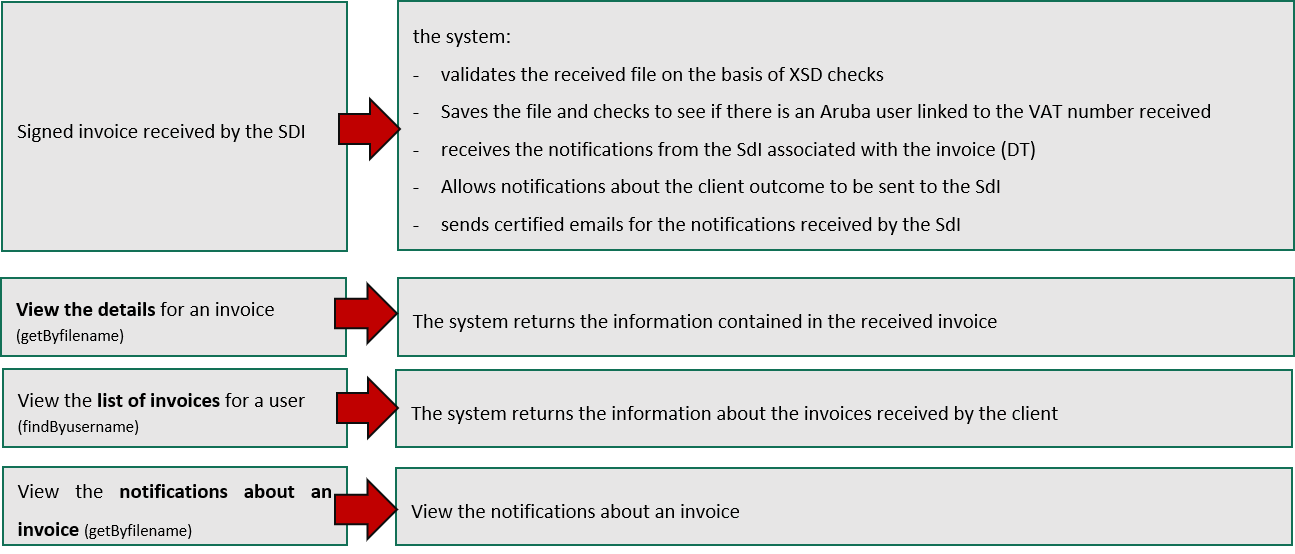

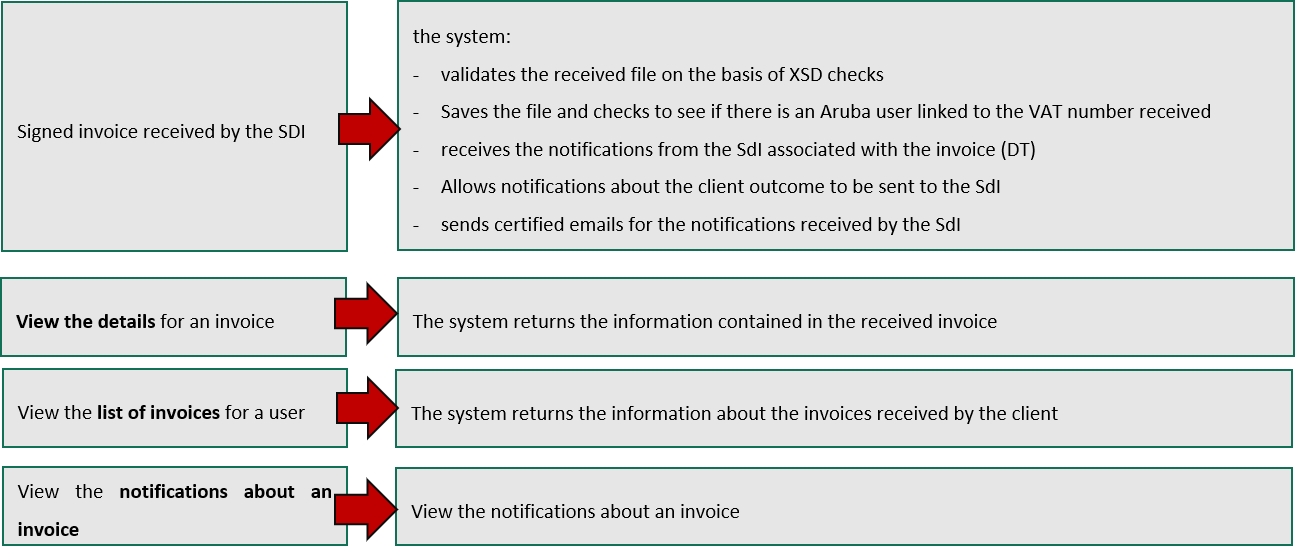

… both to accounts receivable:

… and to accounts payable:

2. Environments

There are two environments for integration with Electronic Invoicing services.

DEMO: Environment with equivalent functionalities to the production environment, but only available temporarily, with specific login details. The details entered are confirmed and maintained for as long as the user account is valid.

PRODUCTION: Production environment available to holder users of the service.

The table below shows the base URLs that need to precede the paths for the authentication methods (Authentication Chapter) and for other methods (Chapters entitled: Financial Communications, Transmission of Electronic Invoices, Find Invoices Sent, Find Invoices Received, Send Customer Result, Find Notifications on Invoices Sent and Find Notifications on Invoices Received).

BASE URL |

AMBIENTE |

|

|---|---|---|

Demo |

Production |

|

Authentication |

||

Other methods |

||

Please note that once you have received your login details, you will need to complete the registration by using them to log in to the online control panel for Aruba Electronic Billing. From the online control panel, you can also view data (e.g. sent invoices, received invoices) and configure the Electronic Billing service (e.g. receive emails, mandate requests, assignors).

In the table below, you can find the link to the online control panel for electronic billing for the DEMO and PRODUCTION environments.

ONLINE CONTROL PANEL LINK |

|

|---|---|

Demo |

Production |

3. SLA (Service Level Agreement)

The Electronic Invoicing API limits clients to a certain number of calls. These limits can be found in the table below.

| Service | SLA |

|---|---|

Maximum no. authentication requests per IP |

1 per minute |

Maximum sent files size |

5 MB |

Maximum no. requests to send invoices per IP (Upload invoice) |

30 per minute |

Maximum no. requests to send invoices that have already been signed per IP (Upload invoice signed) |

30 per minute |

Maximum no. requests to find sent invoices per IP (Find Invoices Sent) |

12 per minute |

Maximum no. requests to find received invoices per IP (Find Invoices Received) |

12 per minute |

Maximum no. requests to find notifications for sent invoices per IP (Find Notifications on Invoices Sent) |

12 per minute |

Maximum no. requests to find notifications for received invoices per IP (Find Notifications on Invoices Received) |

12 per minute |

Comprehensive SLA |

99.95% uptime for the Web interface and Web Services |

Processing the invoice file |

Within 24 hours of receipt by the client |

Sending the invoice file to the SDI |

Within 24 hours of processing the invoice file |

Sending the outcome notification to the client |

Within 24 hours of receipt by the Exchange System |

Sending invoice file and outcome notification to the Storage System |

Within the times stipulated by the regulations in force |

4. HTTP status codes

The following are the HTTP status codes that might be received by an Electronic Invoicing API client.

| Status code | Meaning |

|---|---|

|

Standard response for successful HTTP requests. |

|

The request has been met, returning the creation of a new resource |

|

The server has successfully processed the request and no content will be returned. |

|

The request cannot be met due to syntax errors. |

|

Similar to 403/Forbidden, but designed for use when authentication is possible but it has failed and cannot be met. |

|

The request is valid but is declined by the server. The user may not have the necessary authorization to access the resource. |

|

The resource requested has not been found. |

|

Limits described in the SLA (Service Level Agreement) exceeded |

|

Limits described in the SLA (Service Level Agreement) exceeded |

|

Generic error message with no details. |

5. Authentication

To access the Electronic Billing service, you will need to sign in as follows.

|

to invoke the authentication methods the path method is preceded by the relevant base URL |

|

As calls to the Autentication methods involve providing sensitive information, when invoking them users need to protect their data as follows.

|

5.1. signin

POST authentication base url/auth/signin

The method is used to request a security token. This token is required to invoke the methods of the various Electronic Invoicing servers (Resource Servers) that are protected by the system.

| The token expires after 30 minutes. |

The following request parameters must be in the format application/x-www-form-urlencoded with UTF-8 encoding.

| Parameter | Description | Constraints |

|---|---|---|

|

Type of grant used for authentication. Normally the same as "password" |

Mandatory |

|

The user’s username |

Mandatory |

|

The user’s password |

Mandatory |

HTTP request

POST /auth/signin HTTP/1.1

Content-Type: application/x-www-form-urlencoded;charset=UTF-8

grant_type=password&username=Utente&password=PasswordHTTP response

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: 278

{

"access_token" : "651c840b5ef83dc6",

"token_type" : "bearer",

"expires_in" : 1800,

"refresh_token" : "36dc329f0a114974",

"userName" : "Utente",

"as:client_id" : "Auth",

".issued" : "Tue, 20 May 2025 09:43:03 GMT",

".expires" : "Tue, 20 May 2025 10:13:03 GMT"

}Response fields

| Field | Type | Description |

|---|---|---|

|

|

Access token |

|

|

Type of token returned. Constant = "bearer" |

|

|

Number of seconds (remaining) before the token expires |

|

|

Refresh Token to be used to obtain a new token |

|

|

Client who has requested the token |

|

|

User logged in |

|

|

Date/Time of ticket issue in the format: EEE, dd MMM yyyy HH:mm:ss z |

|

|

Date/Time of expiry issue in the format: EEE, dd MMM yyyy HH:mm:ss z |

If an error occurs, the system will return the Http status code 400 Bad Request with the following response

HTTP/1.1 400 Bad Request

Content-Type: application/json;charset=UTF-8

Content-Length: 98

{

"error" : "invalid_grant",

"error_description" : "The user name or password is incorrect."

}where

| Field | Type | Description |

|---|---|---|

|

|

Error Code |

|

|

Description of the error |

The access token must be used to invoke the following methods. In particular, a header must be entered in the HTTP request, consisting of the following:

| Header Name | Header Value |

|---|---|

Authorization |

Bearer <access_token> |

Requests without a security token (or with an incorrect / expired token) will receive the Http status code 401 Unauthorized

with the message: "Full authentication is required to access this resource".

|

5.2. refresh

POST authentication base url/auth/signin

The token can be renewed by submitting a refresh request, which requires the following parameters in the format

application/x-www-form-urlencoded with UTF-8 encoding. Refreshing the token, avoiding sending login details,

offers more security and a more efficient process than requesting a new token via signin.

If a valid refresh token is not specified, the refresh process returns an "invalid_grant" error message

|

The refresh token is valid for 60 minutes from the time of issue (.issued),

thereby allowing a token to be updated for up to 30 minutes after its expiry (.expires)

|

The following request parameters must be in the format application/x-www-form-urlencoded with UTF-8 encoding.

| Parameter | Description | Constraints |

|---|---|---|

|

Constant = "refresh_token" |

Mandatory |

|

Refresh token returned in the above request |

Mandatory |

For example:

POST /auth/signin HTTP/1.1

Content-Type: application/x-www-form-urlencoded;charset=UTF-8

grant_type=refresh_token&refresh_token=ee4aae0c9d754ad08a657510cae82efeThe response is identical to the previous one. Another access token (and relevant refresh token) is issued.

5.3. userInfo

GET authentication base url/auth/userInfo

This method lets you retrieve user information relating to the authentication token.

HTTP request

GET /auth/userInfo HTTP/1.1

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=Request headers

| Name | Description |

|---|---|

|

Authorization Access token obtained by signin |

HTTP response

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: 347

{

"username" : "ARUBA0000",

"pec" : "pec@pec.it",

"userDescription" : "Aruba PEC S.p.A.",

"countryCode" : "IT",

"vatCode" : "01879020517",

"fiscalCode" : "01879020517",

"accountStatus" : {

"expired" : false,

"expirationDate" : "2025-08-20"

},

"usageStatus" : {

"usedSpaceKB" : 262144,

"maxSpaceKB" : 1048576

}

}Response fields

| Field | Type | Description |

|---|---|---|

|

|

Username |

|

|

Certified email address |

|

|

First name and surname or company name |

|

|

Country code (e.g. IT for Italy) |

|

|

VAT number |

|

|

Tax code |

|

|

true if the user has expired or been suspended, otherwise false |

|

|

Expiry date for user in the format |

|

|

Storage space used in kilobytes |

|

|

Storage space purchased in kilobytes |

5.4. multicedenti

GET base url autenticazione/auth/multicedenti

This method allows you to recuperate information on the user’s multisellers Premium related to authentication token.

HTTP request

GET /auth/multicedenti HTTP/1.1

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=Request headers

| Name | Description |

|---|---|

|

Authorization Access token obtained by signin |

Request parameters

| Parameter | Description | Constraints |

|---|---|---|

|

Country code (e.g. IT for Italy) |

Not required |

|

VAT number |

Not required |

|

Not required |

|

|

Page size (default 10) |

Between 1 and 100 |

|

page requested (default 1) |

Between 1 and totalPages |

HTTP response

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: 665

{

"first" : true,

"last" : true,

"number" : 1,

"numberOfElements" : 2,

"size" : 2,

"totalElements" : null,

"totalPages" : 1,

"content" : [ {

"description" : "Multicedente di esempio 1",

"countryCode" : "IT",

"vatCode" : "98765123453",

"usedSpaceKB" : 7,

"creationDate" : "2022-08-04T10:50:05.571+02:00",

"id" : "5dee624a18ba9a66af3ef417",

"status" : "ACTIVE"

}, {

"description" : "Multicedente di esempio 2",

"countryCode" : "IT",

"vatCode" : "12345634512",

"usedSpaceKB" : 123,

"creationDate" : "2022-08-04T10:50:05.571+02:00",

"id" : "62eb883d89ec1c5540f80cb1",

"status" : "ACTIVE"

} ]

}Response fields

| Field | Type | Description |

|---|---|---|

|

|

Array of multisellers found |

|

|

true if the page found is the first, otherwise false |

|

|

true if the page found is the last, otherwise false |

|

|

Current page number |

|

|

Number of elements returned |

|

|

Page size |

|

|

Total number of multisellers found |

|

|

Total number of pages |

|

|

Country code (e.g. IT for Italy) |

|

|

Creation date |

|

|

Company name |

|

|

Multiseller IDs |

|

|

Multiseller status |

|

|

Storage space used in kilobytes |

|

|

VAT number |

5.5. multicedenteById

GET base url autenticazione/auth/multicedenti/{id}

This method allows you to recuperate information on a single multiseller.

HTTP request

GET /auth/multicedenti/62eb883d89ec1c5540f80cb1 HTTP/1.1

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=Request headers

| Name | Description |

|---|---|

|

Authorization Access token obtained by signin |

HTTP response

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: 237

{

"description" : "Multicedente di esempio 2",

"countryCode" : "IT",

"vatCode" : "12345634512",

"usedSpaceKB" : 123,

"creationDate" : "2022-08-04T10:50:05.571+02:00",

"id" : "62eb883d89ec1c5540f80cb1",

"status" : "ACTIVE"

}Response fields

| Field | Type | Description |

|---|---|---|

|

|

Country code (e.g. IT for Italy) |

|

|

Creation date |

|

|

Company name |

|

|

Multiseller IDs |

|

|

Multiseller status |

|

|

Storage space used in kilobytes |

|

|

VAT number |

5.6. Status of multisellers

| Status | Status Code | Description |

|---|---|---|

Connected |

ACTIVE |

Multiseller connected |

Suspended |

SUSPEND |

Multiseller suspended |

Not active |

INACTIVE |

Multiseller not active |

Pending approval |

PENDING |

Multiseller pending approval |

6. Financial Communications

The methods shown for Financial Communications enable the creation of a new transmission request to SDI or recovery of the status of the same request being processed by the Aruba system.

There are two types of transmission request:

-

Invoice Data (known as 'spesometro' data in Italy): xml containing the data relating to one or more invoices issued to several assignees/customers or one or more invoices received also from several assignors/providers. They can be transmitted in a single .xml file or in ZIP files containing several .xml files.

-

VAT payments: file in .xml format containing the communication data relating to the declarant. They can be transmitted in a single .xml file or in ZIP files containing several .xml files.

6.1. CreateTransmissionRequest

POST base url other methods/api/v2/comfin

Creation of a new request for the transmission of "Financial Communications".

|

The |

HTTP request

POST /api/v2/comfin HTTP/1.1

Accept: application/json

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=

Content-Type: application/json;charset=UTF-8

{

"userId" : "ARUBA0000",

"comunicationType" : "LI",

"dataFile" : "dGVzdA=="

}Request fields

| Field | Type | Description | Constraints |

|---|---|---|---|

|

|

Unique ID of the client / user, the same as the username when called by an external client. |

|

|

|

Enum identifying the type of communication CommunicationType |

Mandatory |

|

|

Data attached in Base64 format |

Mandatory |

HTTP response

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: 38

{

"requestId" : "FMGWKSPRJKVHB63F"

}Response fields

| Field | Type | Description |

|---|---|---|

|

|

Unique request code used in subsequent communications (callback / on demand). Only has a value in the case of a positive result (no error code) |

6.2. GetTransmissionInfoRequest

GET base url other methods/api/v2/comfin/{requestId}

Service for querying the status of a request.

HTTP request

GET /api/v2/comfin/XAEURFTHVM HTTP/1.1

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=Path parameters

| Parameter | Description |

|---|---|

|

Unique ID of the request provided in the creation phase |

HTTP response

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: 233

{

"result" : "SF01",

"notifyResult" : "",

"elaboratedResult" : "",

"receiptTimestamp" : "2017-04-18 18:30:30",

"fileId" : "1899466314",

"fileName" : "IT01879020517_LI_0001.xml",

"status" : "",

"pddAvailable" : false

}Response fields

| Field | Type | Description |

|---|---|---|

|

|

Result of request processing |

|

|

XML Base64 with the response obtained from SDI, only when the file has been processed |

|

|

Result code when the file has been processed by SDI |

|

|

Date and time of receipt of file from SDI |

|

|

Unique ID provided by SDI in the request |

|

|

Name of the file generated in accordance with the communication type specifications |

|

|

true if the financial message and the associated outcome files have been saved (see pdd for downloading the preservation package), otherwise false. |

|

|

Status |

6.3. pdd

GET base url other methods/api/v2/comfin/{requestId}/pdd

If pddAvailable is true then this method retrieves the Preservation package as a Zip file of

financial messages, specifying its request ID (requestID).

If however pddAvailable is false, in other words, the Preservation package is not

available, the HTTP status code 404 is returned.

HTTP request

GET /api/v2/comfin/4U6ETUFI4X/pdd HTTP/1.1

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=Path parameters

| Parameter | Description |

|---|---|

|

Unique ID of the request provided in the creation phase |

HTTP response

HTTP/1.1 200 OK

Content-Disposition: attachment; filename="IT01879020517_LI_0001.conservazione.zip"

Content-Type: application/zip

Accept-Ranges: bytes

Content-Length: 8

<binary>6.4. ComunicationType

| Valore | Descrizione |

|---|---|

|

Regular VAT payment |

|

Invoice data |

6.5. ErrorCode

| Valore | Descrizione |

|---|---|

SF01 |

Being processed |

SF02 |

Processed |

SF03 |

Error |

AR01 |

Attached file empty or missing |

AR02 |

Access denied |

AR03 |

Incorrect file |

AR04 |

Request ID missing |

AR05 |

Remote signature missing |

AR06 |

Transmission to SDI not executed |

AR07 |

SDI result response not received |

AR08 |

Incorrect signature |

AR09 |

Third-party transmission not permitted |

AR10 |

Maximum number of invoices and financial communications reached |

AR20 |

Incorrect Communication Type |

AR21 |

File not signed |

AR99 |

Generic error |

6.6. CodiceEsito

| Valore | Descrizione |

|---|---|

|

Regular VAT payment |

|

File valid with reports |

|

Rejected |

7. Transmission of Electronic Invoices

The methods shown enable the creation of a new request to transmit to SDI invoices issued to the Public Administration or private entities.

SDI verifies that the content of the files transmitted is correct and in order, and transmits them to the specified recipient.

The invoices, signed or to be signed, must be sent in an .xml file in accordance with a specific format established by SDI.

7.1. Sender Details

The synchronous check has been introduced for the Sender ID field (tag 1.1.1 <IdTrasmittente> [1] of the XML path),which will have to be filled in with the tax code for the intermediary Aruba PEC S.p.A.: 01879020517.

Below is an example of how to fill in section 1.1 <DatiTrasmissione> [1] of the XML invoice file:

<DatiTrasmissione>

<IdTrasmittente>

<IdPaese>IT</IdPaese>

<IdCodice>01879020517</IdCodice>

</IdTrasmittente>

<!--

...

other XML 1.1 <DatiTrasmissione> tag data:

- 1.1.2 <ProgressivoInvio>

- 1.1.3 <FormatoTrasmissione>

- 1.1.4 <CodiceDestinatario>

...

-->

<ContattiTrasmittente>

<Telefono>05750505</Telefono>

<Email>info@arubapec.it</Email>

</ContattiTrasmittente>

<!--

...

other XML 1.1 <DatiTrasmissione> tag data:

- 1.1.6 <PECDestinatario>

...

-->

</DatiTrasmissione>7.2. Self-billed invoice

A self-billed invoice is a tax document similar to an invoice, issued by the transferee/client on behalf of the transferor/provider (supplier). This is a very specific type of invoice, characterized by the fact that it is the client that is responsible for applying VAT and issuing the invoice.

To issue an electronic self-billed invoice, you will need to fill in the XML file as follows:

-

Populate field 1.6 <SoggettoEmittente> with "CC". This value indicates that the invoice is issued by the Transferee/Client on behalf of the Transferor/Provider;

-

Populate section 1.4 <CessionarioCommittente> with the data for the issuer, or the Transferor/Provider indicated in Aruba’s Electronic Invoicing details (user’s VAT number);

-

Populate section 1.2 <CedentePrestatore> with the supplier’s details.

Aruba Electronic Invoicing will check the XML file received using the following checks on the issuer (transferor/provider indicated in the personal details):

-

if tag 1.6 is not present, a check is carried out to ensure that the VAT number of the issuer matches the VAT number mentioned for the transferor/provider (section 1.2 of the XML file);

-

if tag 1.6 is filled in with "CC", a check is carried out to ensure that the issuer’s VAT number matches the VAT number mentioned for the transferee/client (section 1.4 of the XML file);

-

if tag 1.6 is filled in with "TZ" or if the checks mentioned above are not passed, the system will not accept the invoice.

Self-billed invoices can be issued with one of the following "Document Types", depending on the type of self-billed invoice issued: TD01, TD16, TD17, TD18, TD19, TD20, TD21, TD22, TD23, TD26, TD27.

For more information about the different circumstances and how self-billed invoices are created, you can also refer to the FAQs for:

7.3. Upload invoice

POST base url other methods/services/invoice/upload

This method must be used by the EO to send an invoice in XML format in accordance with AGID standards, but not yet digitally signed.

HTTP request

POST /services/invoice/upload HTTP/1.1

Accept: application/json

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=

Content-Type: application/json;charset=UTF-8

{

"dataFile" : "dGVzdA==",

"credential" : "",

"domain" : "",

"senderPIVA" : "",

"skipExtraSchema" : false,

"dryRun" : false

}| The "domain" and "credential" fields represent the domain and the credentials for the automatic signature respectively, if the user has them, otherwise leave this fields empty or omit them. |

Request headers

| Name | Description |

|---|---|

|

Authorization Access token obtained by signin |

Request fields

| Field | Type | Description | Constraints |

|---|---|---|---|

|

|

Invoice file encoded in Base64 |

Mandatory |

|

|

Signature credentials |

|

|

|

Signature domain |

|

|

|

If the invoice to be sent has code TD26 (disposal of depreciable assets and internal transfers pursuant to art.36 DPR 633/72) as "2.1.1.1 <TipoDocumento>", the senderPIVA field can be used to specifiy whether the assignor/lender or the assignee/client is the invoice sender. The senderPIVA field, if used, must contain the sender’s nation code and VAT number (e.g. IT99999999999 ) |

|

|

|

Default set to false. If set to true, Extra schema synchronous checks and Extra schema asynchronous checks will not be performed. Extra schema synchronous checks and Extra schema asynchronous checks will nevertheless be performed by the Exchange System |

|

|

|

false by default. If set to 'true', the invoice will go through the validation steps but will not be sent to SdI |

HTTP response

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: 161

{

"errorCode" : "0000",

"errorDescription" : "Operazione effettuata - 521e052902be7b879d41e0fd586f0e21",

"uploadFileName" : "IT01481852510_bmbmq.xml.p7m"

}Response fields

| Field | Type | Description |

|---|---|---|

|

|

File name assigned to the invoice |

|

|

File name assigned to the invoice Synchronous Checks |

|

|

Error description, if any. Synchronous Checks and request ID |

|

Request ID: A request ID has been entered in the errorDescription field. This code can be used in the support requests to

speed up resolution.

|

7.4. Upload invoice signed

POST base url other methods/services/invoice/uploadSigned

This method must be used by the EO to send an invoice in XML format that has already been digitally signed in accordance with AGID standards:

-

with the extension .p7m and in CAdES-BES format (CMS Advanced Electronic Signatures);

-

with.xml extension and in XAdES-BES format (XML Advanced Electronic Signatures).

HTTP request

POST /services/invoice/uploadSigned HTTP/1.1

Accept: application/json

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=

Content-Type: application/json;charset=UTF-8

{

"dataFile" : "dGVzdA==",

"senderPIVA" : "",

"skipExtraSchema" : false,

"dryRun" : false

}Request headers

| Name | Description |

|---|---|

|

Authorization Access token obtained by signin |

Request fields

| Field | Type | Description | Constraints |

|---|---|---|---|

|

|

Invoice file encoded in Base64 |

Mandatory |

|

|

If the invoice to be sent has code TD26 (disposal of depreciable assets and internal transfers pursuant to art.36 DPR 633/72) as "2.1.1.1 <TipoDocumento>", the senderPIVA field can be used to specifiy whether the assignor/lender or the assignee/client is the invoice sender. The senderPIVA field, if used, must contain the sender’s nation code and VAT number (e.g. IT99999999999 ) |

|

|

|

Default set to false. If set to true, Extra schema synchronous checks and Extra schema asynchronous checks will not be performed. Extra schema synchronous checks and Extra schema asynchronous checks will nevertheless be performed by the Exchange System |

|

|

|

false by default. If set to 'true', the invoice will go through the validation steps but will not be sent to SdI |

HTTP response

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: 157

{

"errorCode" : "",

"errorDescription" : "Operazione effettuata - 521e052902be7b879d41e0fd586f0e21",

"uploadFileName" : "IT01879020517_zuayu.xml.p7m"

}Response fields

| Field | Type | Description |

|---|---|---|

|

|

File name assigned to the invoice |

|

|

File name assigned to the invoice Synchronous Checks |

|

|

Error description, if any. Synchronous Checks and request ID |

|

Request ID: A request ID has been entered in the errorDescription field. This code can be used in the support requests to

speed up resolution.

|

7.5. Checks

In order to limit the risk of rejection, Aruba’s Electronic Invoicing system carries out some checks on XML electronic invoices received from Web Services. Specifically, the check carried out on the uploaded files involves 2 stages:

-

Synchronous checks: these are carried out when the invoice is received by Aruba’s Electronic Invoicing system, allowing a preliminary analysis of the file. The outcome of these checks decides whether to accept or reject the invoice received. The outcome of synchronous checks is returned immediately with one of the messages indicated in Synchronous Checks.

-

Asynchronous checks: these are carried out after our systems have processed the file. The outcome of these checks results in the invoice being assigned a status:

-

If the invoice passes the checks, it is sent to the Exchange System and marked as "Sent";

-

o If the invoice does not pass the checks, it is not sent to the Exchange System and is marked as "Processing Error"; The outcome of these checks can be retrieved by finding the sent invoices using findInvoices, getInvoiceDetail or Callbacks.

-

7.5.1. Synchronous Checks

| Code | Message | Description of the Check |

|---|---|---|

0000 |

Operazione effettuata |

Invoice sent successfully |

0001 |

Errore imprevisto generico |

Unexpected generic error |

0002 |

Errore parametri in input: emailnotifica, formato mail inserita non valido |

Invalid email format |

0002 |

Errore parametri in input: dataFile, formato fattura errato o non presente |

Invoice not present |

0012 |

Errore di autenticazione al sistema |

User has failed to sign in to the system |

0013 |

Errore in fase di salvataggio dati |

Error when saving on to the db |

0033 |

Il file inviato supera la dimensione massima |

Invoice bigger than the maximum size SLA (Service Level Agreement) |

0034 |

File già inviato di recente |

Invoice already sent and being processed by the system |

0092 |

Errore in validazione XSD: "errore specifico" |

XSD validation with the specific description of the error |

0093 |

Errore deleghe non valide |

Invalid delegated user |

0094 |

La fattura che stai inviando contiene ID e/o contatti dei trasmittenti differenti dai dati dell’intermediario Aruba PEC. |

Sender ID not present or different from Aruba PEC S.p.A |

0095 |

Servizio momentaneamente non disponibile. Il controllo dei permessi è fallito. Si prega di riprovare più tardi. |

The service is temporarily unavailable, the user permissions cannot be verified. |

0096 |

Errore di validazione: "codice" - "messaggio" |

Validation error (Extra schema checks) |

0097 |

Spazio esaurito o non sufficiente, è necessario effettuare un aumento di spazio. |

You need to increase your space, sign in to the web panel for more information. |

0098 |

Formato Base64 non valido. |

The coding in Base64 of the invoice file is invalid. |

Extra schema checks

Synchronous checks for the message 0096, "code" and "message" can be those shown in the table below:

| Sdi Code | Ordinary Invoice Message [1] | Simplified invoice message (if different) [1] | Field in which the check is carried out | Check complete |

|---|---|---|---|---|

00313 |

L’elemento 1.1.4 <CodiceDestinatario> può essere valorizzato con "XXXXXXX" esclusivamente per le fatture emesse verso soggetti non residenti (1.4.1.1 <IdFiscaleIVA> deve essere valorizzato e 1.4.1.1.1 <IdPaese> deve essere diverso da "IT") |

L’elemento 1.1.4 <CodiceDestinatario> può essere valorizzato con "XXXXXXX" per comunicare i dati di fatture emesse esclusivamente verso soggetti non residenti (1.3.1.1 <IdFiscaleIVA> deve essere valorizzato e 1.3.1.1.1 <IdPaese> deve essere diverso da "IT") |

1.1.4 <CodiceDestinatario> |

If line 1.1.4 <CodiceDestinatario> equals "XXXXXXX" (invoice issued to parties not resident, established or located in Italy) it must be verified that the IdPaese field of the transferee/customer contains a value other than "IT" |

7.5.2. Asynchronous Checks

| Message | Description of the check |

|---|---|

|

Error when formally validating the Invoice, check the XML file, contact support |

|

VAT number or Country of the Transferor/Provider not present |

|

VAT number not linked to an Aruba user |

|

Username not found, contact support |

|

Validation error (Extra schema checks) |

|

Username not found, contact support |

|

Delegated user not found, contact support |

|

Check signature or incorrect signature on the invoice |

|

Empty xml file, contact support |

|

ARUBA user disabled, contact support |

|

Formal error in the notification, contact support |

|

File name not present in notification, contact support |

Extra schema checks

Asynchronous checks for the message FATRSM212, "code" and "message" can be those shown in the table below:

| Sdi Code | Ordinary Invoice Message [1] | Simplified invoice message (if different) [1] | Field in which the check is carried out | Check complete |

|---|---|---|---|---|

|

1.4.1.1.2 <IdCodice> non valido |

1.4.1.1.2 <IdCodice> |

Invalid <IdCodice> |

|

|

1.4.1.2 <CodiceFiscale> non valido |

1.4.1.2 <CodiceFiscale> |

Invalid <CodiceFiscale> |

|

|

2.2.1.14 < Natura> non presente a fronte di 2.2.1.12 <AliquotaIVA> pari a zero |

2.2.4 <Natura> non presente a fronte di 2.2.3.2 <Aliquota> pari a zero |

2.2.1.14 <Natura> |

A check is carried out to ensure that it has been entered, if information element 2.2.1.12 <AliquotaIVA> is equal to "0.00", and that it has not been entered, if information element 2.2.1.12 <AliquotaIVA> is anything else |

|

2.2.1.14 <Natura> presente a fronte di 2.2.1.12 <AliquotaIVA> diversa da zero (l’indicazione di un’aliquota IVA diversa da zero qualifica l’operazione come imponibile e quindi non è ammessa la presenza dell’elemento <Natura>, ad eccezione del caso in cui l’elemento TipoDocumento assume valore TD16) |

2.2.4 <Natura> presente a fronte di 2.2.3.2 <Aliquota> diversa da zero (l’indicazione di un’aliquota IVA diversa da zero qualifica l’operazione come imponibile e quindi non è ammessa la presenza dell’elemento <Natura>, ad eccezione del caso in cui l’elemento TipoDocumento assume valore TD16) |

2.2.1.14 <Natura> e 2.2.1.12 <AliquotaIVA> |

Check that field contains a value, if item 2.2.1.12 <AliquotaIVA> equals "0.00", and that it does not contain a value if item 2.2.1.12 <AliquotaIVA> is something other than "0.00" (except when item 2.1.1.1 <TipoDocumento> equals TD16) |

|

2.1.1.3 <Data> successiva alla data di ricezione |

2.1.1.3 <Data> |

Check to ensure that this date is not after the date on which the file was received by the Exchange System. In addition, if information element 2.1.1.1 <TipoDocumento> is "TD04", a check is carried out to ensure that it is not before the one provided in information element 2.1.6.3 <Data> |

|

|

2.1.1.5 <DatiRitenuta> non presente a fronte di almeno un blocco 2.2.1 <DettaglioLinee> con 2.2.1.13 <Ritenuta> uguale a SI |

2.1.1.5 <DatiRitenuta> |

A check is carried out to ensure that this block is present with at least one block 2.2.1 <DettaglioLinee> with element 2.2.1.13 <Ritenuta> equal to 'SI' and/or a block 2.1.1.7 <DatiCassaPrevidenziale> with element 2.1.1.7.6 <Ritenuta> equal to 'SI' |

|

|

2.1.1.7.7 <Natura> non presente a fronte di 2.1.1.7.5 <AliquotaIVA> pari a zero |

2.1.1.7.7 <Natura> |

A check is carried out to ensure that it has been entered, of information element 2.1.1.7.5 <AliquotaIVA> is equal to "0.00", and that it has not been entered, if information element 2.1.1.7.5 <AliquotaIVA> is different from "0.00" |

|

|

2.1.1.5 <DatiRitenuta> non presente a fronte di 2.1.1.7.6 <Ritenuta> uguale a SI |

2.1.1.7.6 <Ritenuta> |

If it is set to "SI", a check is carried out to ensure that there is the block 2.1.1.5 <DatiRitenuta> |

|

|

1.4.1.1 <IdFiscaleIVA> e 1.4.1.2 <CodiceFiscale> non valorizzati (almeno uno dei due deve essere valorizzato) |

1.4.1.1 <IdFiscaleIVA> and 1.4.1.2 <CodiceFiscale> |

1.4.1.2 <CodiceFiscale>: If it is not entered, a check is carried out to ensure that block 1.4.1.1 <IdFiscaleIVA> is entered, if entered, a check is carried out that it exists in the Tax Register |

|

|

2.1.1.3 <Data> antecedente a 2.1.6.3 <Data> |

2.1.1.3 <Data> |

2.1.1.3 <Data> before 2.1.6.3 <Data> |

|

|

2.2.2 <DatiRiepilogo> non presente in corrispondenza di almeno un valore di 2.1.1.7.5 <AliquotaIVA> o 2.2.1.12 <AliquotaIVA> |

2.2.2 <DatiRiepilogo> |

A check is carried out to ensure that the number of blocks 2.2.2. <DatiRiepilogo> is more than or equal to the number of VAT rates in the document |

|

|

2.2.2.2 <Natura> con valore N6 (inversione contabile) a fronte di 2.2.2.7 <EsigibilitaIVA> uguale a S (scissione pagamenti) |

2.2.2.2 <Natura> or 2.2.2.7 <EsigibilitaIVA> |

If 2.2.2.2 <Natura> is entered as "N6", a check is carried out to ensure information element 2.2.2.7 <EsigibilitaIVA> is not entered as "S". A check is carried out to ensure that it has been entered, if information element 2.2.2.1 <AliquotaIVA> is equal to "0.00", and that it has not been entered, if information element 2.2.2.1 <AliquotaIVA> is different from "0.00". |

|

|

2.2.1.12 <AliquotaIVA> o 2.2.2.1< AliquotaIVA> o 2.1.1.7.5 <AliquotaIVA> non indicata in termini percentuali |

2.2.3.2 <Aliquota> non indicata in termini percentuali |

2.2.1.12 <AliquotaIVA> or 2.2.2.1< AliquotaIVA> or 2.1.1.7.5 <AliquotaIVA> |

Check to ensure that the value is expressed as a percentage (e.g.: "22.00" and not "0.22") |

|

2.1.1.4 <Numero> non contenente caratteri numerici |

2.1.1.4 <Numero> |

Check to ensure it contains at least one number |

|

|

1.1.4 <CodiceDestinatario> di 7 caratteri a fronte di 1.1.3 <FormatoTrasmissione> con valore "FPA12" o 1.1.4 <CodiceDestinatario> di 6 caratteri a fronte di 1.1.3 <FormatoTrasmissione> con valore "FPR12" |

1.1.4 <CodiceDestinatario> |

<CodiceDestinatario> with 7 characters against 1.1.3 <FormatoTrasmissione> with the value "FPA12" or 1.1.4 <CodiceDestinatario> with 6 characters against 1.1.3 <FormatoTrasmissione> with the value "FPR12" |

|

|

1.1.3 <FormatoTrasmissione> con valore diverso da "FPA12" e "FPR12" |

1.1.3 <FormatoTrasmissione> |

A check is carried out to ensure consistency with information element 1.1.4 <CodiceDestinatario>: if "FPA12", information element 1.1.4 must be 6 characters; if "FPR12", information element 1.1.4 must be 7 characters. |

|

|

2.2.2.2 < Natura> non presente a fronte di 2.2.2.1 <AliquotaIVA> pari a zero |

2.2.2.2 <Natura> |

2.2.2.2 < Natura> not present against 2.2.2.1 <AliquotaIVA> equal to zero |

|

|

2.2.2.2 <Natura> presente a fronte di 2.2.2.1 <AliquotaIVA> diversa da zero |

2.2.2.2 <Natura> |

Check that field contains a value, if item 2.2.1.1 <AliquotaIVA> equals "0.00", and that it does not contain a value if item 2.2.1.1 <AliquotaIVA> is something other than "0.00" (except when item 2.1.1.1 <TipoDocumento> equals TD16) |

|

|

2.1.1.8.2 <Percentuale> e 2.1.1.8.3 <Importo> non presenti a fronte di 2.1.1.8.1 <Tipo> valorizzato |

<ScontoMaggiorazione> 2.1.1.8 |

2.1.1.8.1 <Tipo>: If entered, a check is carried out to ensure that there is at least one of the two elements 2.1.1.8.2 <Percentuale> and 2.1.1.8.3 <Importo> |

|

|

2.2.1.10.2 <Percentuale> e 2.2.1.10.3 <Importo> non presenti a fronte di 2.2.1.10.1 <Tipo> valorizzato |

<ScontoMaggiorazione> 2.2.1.10.1 |

If entered, a check is carried out to ensure that there is at least one of the two elements 2.2.1.10.2 <Percentuale> and 2.2.1.10.3 <Importo> |

|

|

Non c’è corrispondenza tra i valori indicati nell’elemento 2.2.1.12 <AliquotaIVA> o 2.1.1.7.5 <AliquotaIVA> e quelli dell’elemento 2.2.2.1 <AliquotaIVA> |

2.1.1.7.5 <AliquotaIVA> o 2.2.1.12 <AliquotaIVA> e 2.2.2.1 <AliquotaIVA> |

Check is performed to verify that the value provided in this item also appears in item 2.2.2.1 <AliquotaIVA> of one of the 2.2.2 <DatiRiepilogo> blocks listed in the invoice. Check is performed to verify that the value provided in this item also appears in item 2.2.1.12 <AliquotaIVA> of one of the 2.2.1 <DettaglioLinee> blocks listed in the invoice or in item 2.1.1.7.5 <AliquotaIVA> in one of the 2.1.1.7 <DatiCassaPrevidenziale> blocks listed in the invoice |

|

|

Non c’è corrispondenza tra i valori indicati nell’elemento 2.2.1.14 <Natura> o 2.1.1.7.7 <Natura> e quelli dell’elemento 2.2.2.2 <Natura> |

2.1.1.7.7 <Natura> o 2.2.1.14 <Natura> e 2.2.2.2 <Natura> |

Check is performed to verify that the value provided in this item also appears in item 2.2.2.2 <Natura> of one of the 2.2.2 <DatiRiepilogo> blocks listed in the invoice. Check is performed to verify that the value provided in this item also appears in item 2.2.1.14 <Natura> of one of the 2.2.1 <DettaglioLinee> blocks listed in the invoice or in item 2.1.1.7.7 <Natura> of one of the 2.1.1.7 <DatiCassaPrevidenziale> blocks listed in the invoice |

|

|

Non è più ammesso il valore generico N2, N3 o N6 come codice natura dell’operazione |

Non è più ammesso il valore generico N2 o N3 come codice natura dell’operazione |

2.1.1.7.7 <Natura> o 2.2.1.14 <Natura> o 2.2.2.2 <Natura> o 2.2.4 <Natura> (semplificata) |

From 1 January 2021 a check will be performed to verify that the value provided in this item is different from N2, N3 and N6 (values no longer permitted) |

|

Importo totale superiore al limite previsto per le fatture semplificate ai sensi del DPR 633/72, art. 21 bis |

2.2.2 <Importo> |

The value in this field (or the sum of the values in this field if there is more than one block 2.2 <DatiBeniServizi>) cannot be greater than 400.00 Euros. This limit may only be exceeded if block 2.1.2 <DatiFatturaRettificata> is imposed |

|

|

Per il valore indicato nell’elemento 2.1.1.1 <TipoDocumento> il cedente/prestatore non può essere uguale al cessionario/committente (i valori del tipo documento TD01, TD02, TD03, TD06, TD16, TD17, TD18, TD19, TD20, TD24, TD25 e TD28 (fatture ordinarie) e TD07 (fatture semplificate) non ammettono l’indicazione in fattura dello stesso soggetto sia come cedente che come cessionario) |

2.1.1.1 <TipoDocumento> |

If item 2.1.1.1 <TipoDocumento> equals TD01, TD02, TD03, TD06, TD16, TD17, TD18, TD19, TD20, TD24, TD25 or TD28, a check is performed to verify that the supplier/provider and the assignee/customer are different persons |

|

|

Per il valore indicato nell’elemento 2.1.1.1 <TipoDocumento> il cedente/prestatore deve essere uguale al cessionario/committente (i valori TD21 e TD27 non ammettono l’indicazione in fattura di un cedente diverso dal cessionario) |

2.1.1.1 <TipoDocumento> |

If item 2.1.1.1 <TipoDocumento> equals TD21 or TD27, a check is performed to verify that the supplier/provider and the assignee/customer are the same person |

|

|

Per il valore indicato nell’elemento 2.1.1.1 <TipoDocumento> non è ammesso il valore IT nell’elemento 1.2.1.1.1 <IdPaese> (i valoriTD17, TD18, TD19 e TD28 del tipo documento non ammettonol’indicazione in fattura di un cedente italiano. Nei casi di TD17 e TD19 è ammessa l’indicazione del valore 'OO' nell’elemento 1.2.1.1.1 <IdPaese>per operazioni effettuate da soggetti residenti in Livigno e Campione d’Italia. Inoltre, nel caso del TD28, l’elemento 1.2.1.1.1 <IdPaese> deve essere valorizzato con il valore SM)(vale solo per le fatture ordinarie) |

2.1.1.1 <TipoDocumento> e 1.2.1.1.1 <IdPaese> |

If item 2.1.1.1 <TipoDocumento> equals TD17, TD18, TD19 or TD28, a check is performed to verify that 1.2.1.1.1<IdPaese> of the supplier/provider is not "IT" and that, in the case of TD28, it is "SM" |

|

|

Per il valore indicato nell’elemento 2.1.1.1 <TipoDocumento> non sono ammesse linee di dettaglio con l’elemento 2.2.1.12 <AliquotaIVA> contenente valore zero |

2.1.1.1 <TipoDocumento> e 2.2.1.12 <AliquotaIVA> |

A check is performed to verify that no lines in the invoice contain a 2.2.1.12<AliquotaIVA> field with a zero value |

|

|

Per il valore indicato nell’elemento 2.1.1.1 <TipoDocumento> deve essere presente l’elemento 1.4.1.1 <IdFiscaleIVA> del cessionario/committente (i tipi documento TD16, TD17, TD18, TD19, TD20, TD22, TD23 e TD28 prevedono obbligatoriamente la presenza della partita IVA del cessionario/committente) |

2.1.1.1 <TipoDocumento> e 1.4.1.1 <IdFiscaleIVA> |

If item 2.1.1.1 <TipoDocumento> equals TD16, TD17, TD18, TD19, TD20, TD22, TD23 or TD28, a check is performed to verify that the block 1.4.1.1 <IdFiscaleIVA> of the assignee/customer contains a value |

|

|

Gli elementi 1.2.1.1.1 <IdPaese> e 1.4.1.1.1 <IdPaese> non possono essere entrambi valorizzati con codice diverso da IT (non è ammessa una fattura riportante contemporaneamente nel paese dell’identificativo fiscale del cedente/prestatore e del cessionario/committente un valore diverso da IT) |

Gli elementi 1.2.1.1 <IdPaese> (cedente) e 1.3.1.1.1 <IdPaese> (cessionario) non possono essere entrambi valorizzati con codice diverso da IT (non è ammessa una fattura riportante contemporaneamente nel paese dell’identificativo fiscale del cedente/prestatore e del cessionario/committente un valore diverso da IT) |

1.2.1.1.1 <IdPaese> (cedente) e 1.4.1.1.1 <IdPaese> |

If item 1.2.1.1.1 <IdPaese> contains a value different from "IT", a check is performed to verify that item 1.4.1.1.1 <IdPaese> is not different from "IT" as well |

8. Find Invoices Sent

Methods of finding sent invoices.

8.1. Invoice status

Below is the list of Invoice Statuses that can be achieved by employing the methods described in this and the following chapter.

| Status | Status Code | SDI Notification Type | Description |

|---|---|---|---|

Presa in carico |

1 |

The invoice is waiting to be processed by Aruba’s systems and has not yet been sent to the SDI. |

|

Errore elaborazione |

2 |

An error has occurred when processing the invoice (technical problem sending to the SDI). |

|

Inviata |

3 |

The invoice has been sent to the Exchange System (SDI). |

|

Scartata |

4 |

NS |

The invoice has been rejected by the Exchange System (SDI), which has returned a specific error code. |

Non consegnata |

5 |

MC |

Delivery of the invoice by the Exchange System (SDI) has failed. For PAs only, the system will attempt to deliver again in the next 10 days. |

Recapito impossibile |

6 |

AT |

Delivery of the invoice by the Exchange System (SDI) has not been successful. No further attempts will be made to deliver it. |

Consegnata |

7 |

RC |

The invoice has been delivered by the Exchange System (SDI). |

Accettata |

8 |

NE (EC01) |

The client has accepted the invoice delivered by the Exchange System (SDI). |

Rifiutata |

9 |

NE (EC02) |

The client has rejected the invoice delivered by the Exchange System (SDI). |

Decorrenza termini |

10 |

DT |

The invoice has been delivered by the Exchange System (SDI) but the client has not responded within 15 days of delivery. |

Ricevuta |

MT |

Invoices received come with the Metadata Notification that the SDI exchange system sends the recipient with the invoice. |

8.2. findInvoices

GET base url other methods/api/v2/invoices-out

This method returns the list of electronic invoices sent by the user and processed by the system. The list of Invoices is returned without the content in base64 (lazy loading).

HTTP request

GET /api/v2/invoices-out HTTP/1.1

Accept: application/json

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=Request headers

| Name | Description |

|---|---|

|

Authorization Access token obtained by signin |

Request parameters

| Parameter | Description | Constraints |

|---|---|---|

|

page requested (default 1) |

Between 1 and totalPages |

|

page size (default 10) |

Between 1 and 100 |

|

Invoice creation date (from) |

Mandatory, in ISO 8601 format, the difference with creationEndDate cannot be more than 2 days |

|

Invoice creation date (to) |

Mandatory, in ISO 8601 format, the difference with creationStartDate cannot be more than 2 days |

|

Country Code of the assignor/provider |

Mandatory if the user is a Premium user |

|

VAT number of the assignor/provider |

Mandatory if the user is a Premium user |

|

Country Code of the assignee/customer |

|

|

VAT number of the assignee/customer |

|

|

Tax code of the assignee/customer |

|

|

Invoice status |

|

|

Document type |

|

|

Last invoice modification date (from) |

In ISO 8601 format |

|

Last invoice modification date (to) |

In ISO 8601 format |

HTTP response

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: 4072

{

"content" : [ {

"channelGroup" : 2,

"shopName" : "null",

"invoices" : [ {

"invoiceDate" : "2025-05-20T09:43:02.466Z",

"number" : "1",

"documentType" : "TD01",

"status" : "Inviata",

"statusDescription" : "",

"totalDocument" : 100.0,

"totalVat" : 27.0,

"netPayable" : 100.0

} ],

"sdiErrors" : [ ],

"id" : "1",

"sender" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "6372762541",

"fiscalCode" : "N5Hnt9vvMZ"

},

"receiver" : {

"description" : "Rossi SRL",

"countryCode" : "IT",

"vatCode" : "8767263441",

"fiscalCode" : "LVZTeOJ8BN"

},

"invoiceType" : "FPR12",

"docType" : "out",

"file" : null,

"filename" : "IT01879020517_jtlk1.xml.p7m",

"username" : "Utente",

"creationDate" : "2025-05-20T09:43:02.466+0000",

"lastUpdate" : "2025-05-20T09:43:02.466+0000",

"idSdi" : "7895",

"pddAvailable" : true

}, {

"channelGroup" : 2,

"shopName" : "null",

"invoices" : [ {

"invoiceDate" : "2025-05-20T09:43:02.466Z",

"number" : "1",

"documentType" : "TD01",

"status" : "Inviata",

"statusDescription" : "",

"totalDocument" : 100.0,

"totalVat" : 27.0,

"netPayable" : 100.0

} ],

"sdiErrors" : [ ],

"id" : "2",

"sender" : {

"description" : "Aruba SPA",

"countryCode" : "FZQ",

"vatCode" : "5053049931",

"fiscalCode" : "ke8lPz0OLO"

},

"receiver" : {

"description" : "Rossi SRL",

"countryCode" : "IT",

"vatCode" : "9949436171",

"fiscalCode" : "6W021XqtYu"

},

"invoiceType" : "FPR12",

"docType" : "out",

"file" : null,

"filename" : "IT01879020517_zuayu.xml.p7m",

"username" : "Utente",

"creationDate" : "2025-05-20T09:43:02.466+0000",

"lastUpdate" : "2025-05-20T09:43:02.466+0000",

"idSdi" : "7895",

"pddAvailable" : true

}, {

"channelGroup" : 2,

"shopName" : "null",

"invoices" : [ {

"invoiceDate" : "2025-05-20T09:43:02.466Z",

"number" : "1",

"documentType" : "TD01",

"status" : "Inviata",

"statusDescription" : "",

"totalDocument" : 100.0,

"totalVat" : 27.0,

"netPayable" : 100.0

} ],

"sdiErrors" : [ ],

"id" : "3",

"sender" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "08244281889",

"fiscalCode" : "13531100508"

},

"receiver" : {

"description" : "Rossi SRL",

"countryCode" : "IT",

"vatCode" : "50133360196",

"fiscalCode" : "67928264521"

},

"invoiceType" : "FPR12",

"docType" : "out",

"file" : null,

"filename" : "IT01481852510_bmbmq.xml.p7m",

"username" : "Utente",

"creationDate" : "2025-05-20T09:43:02.466+0000",

"lastUpdate" : "2025-05-20T09:43:02.466+0000",

"idSdi" : "7895",

"pddAvailable" : true

}, {

"channelGroup" : 2,

"shopName" : "null",

"invoices" : [ {

"invoiceDate" : "2025-05-20T09:43:02.466Z",

"number" : "1",

"documentType" : "TD01",

"status" : "Inviata",

"statusDescription" : "",

"totalDocument" : 100.0,

"totalVat" : 27.0,

"netPayable" : 100.0

} ],

"sdiErrors" : [ ],

"id" : "4",

"sender" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "77237465971",

"fiscalCode" : "50783824837"

},

"receiver" : {

"description" : "Rossi SRL",

"countryCode" : "IT",

"vatCode" : "98293260037",

"fiscalCode" : "88644958723"

},

"invoiceType" : "FPR12",

"docType" : "out",

"file" : null,

"filename" : "IT08847382200_etbcl.xml.p7m",

"username" : "Utente",

"creationDate" : "2025-05-20T09:43:02.466+0000",

"lastUpdate" : "2025-05-20T09:43:02.466+0000",

"idSdi" : "7895",

"pddAvailable" : true

} ],

"first" : true,

"last" : true,

"totalElements" : 4,

"totalPages" : 1,

"size" : 10,

"number" : 1,

"numberOfElements" : 4

}Response fields

| Field | Type | Description |

|---|---|---|

|

|

Array of invoices found |

|

|

true if the page found is the last, otherwise false |

|

|

Total number of invoices found |

|

|

Total number of pages |

|

|

Page size |

|

|

Current page number |

|

|

true if the page found is the first, otherwise false |

|

|

Number of elements returned |

|

|

Array of individual invoices in the batch |

|

|

Invoice ID |

|

|

Company sender |

|

|

Company receiver |

|

|

Transmission format (e.g. 'FPA12' or 'FPR12', etc.) |

|

|

out for sent invoice, in for received invoice |

|

|

File in Base64 format |

|

|

Filename (es. IT01879020517_abcde.xml.p7m) |

|

|

Username of the owner of the invoice |

|

|

Creation date, i.e. the date on which the invoice was received by Aruba Electronic Billing |

|

|

Date of last update |

|

|

SDI (Exchange System) ID |

|

|

true if the invoice and associated notifications have been saved (see getInvoicePdd for downloading the preservation package), otherwise _false _ |

|

|

Invoice channel |

|

|

Name of shop if invoice comes from ecommerce |

|

|

List of errors in the possible rejection notification |

|

|

Name of transferor provider |

|

|

Country code of transferor provider (e.g.) 'IT', 'DE' etc.) |

|

|

VAT number transferor provider |

|

|

Tax code transferor provider |

|

|

Name of transferee client |

|

|

Country code of transferee client (e.g. 'IT', 'DE' etc.) |

|

|

VAT number of transferee client |

|

|

Tax code of transferee client |

|

|

Invoice date |

|

|

Invoice number |

|

|

Total document |

|

|

Total Vat |

|

|

Net payable |

|

|

Document type |

|

|

|

|

|

Contains one of the messages in Asynchronous Checks if status is Errore Elaborazione, otherwise null |

8.3. getInvoiceDetail

GET base url other methods/api/v2/invoices-out/detail

Finds for an individual invoice by id, invoice filename or idSdi.

HTTP request

GET /api/v2/invoices-out/detail?id=1 HTTP/1.1

Accept: application/json

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=Request headers

| Name | Description |

|---|---|

|

Authorization Access token obtained by signin |

Request parameters

| Parameter | Description | Constraints |

|---|---|---|

|

Invoice Id |

Mandatory if neither idSdi nor filename are specified |

|

File name of invoice |

Mandatory if neither id nor idSdi are specified |

|

SdI Id |

Mandatory if neither id nor filename are specified |

|

If value is true, |

Not required. Default value is false |

|

If value is false, |

Not required. Default value is true |

HTTP response

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: 948

{

"channelGroup" : 2,

"shopName" : "null",

"invoices" : [ {

"invoiceDate" : "2025-05-20T09:43:02.382Z",

"number" : "1",

"documentType" : "TD01",

"status" : "Inviata",

"statusDescription" : "",

"totalDocument" : 100.0,

"totalVat" : 27.0,

"netPayable" : 100.0

} ],

"sdiErrors" : [ ],

"id" : "1",

"sender" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "6372762541",

"fiscalCode" : "N5Hnt9vvMZ"

},

"receiver" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "8767263441",

"fiscalCode" : "LVZTeOJ8BN"

},

"invoiceType" : "FPR12",

"docType" : "out",

"file" : "ZEdWemRBPT0=",

"filename" : "IT01879020517_jtlk1.xml.p7m",

"username" : "Utente",

"creationDate" : "2025-05-20T09:43:02.382+0000",

"lastUpdate" : "2025-05-20T09:43:02.382+0000",

"idSdi" : "9998l",

"pdfFile" : "ZEdWemRGQmtaZz09",

"pddAvailable" : true

}Response fields

| Field | Type | Description |

|---|---|---|

|

|

Array of individual invoices in the batch |

|

|

Invoice ID |

|

|

Company sender |

|

|

Company receiver |

|

|

Transmission format (e.g. 'FPA12' or 'FPR12', etc.) |

|

|

out for sent invoice, in for received invoice |

|

|

File in Base64 format |

|

|

Filename (es. IT01879020517_abcde.xml.p7m) |

|

|

Username of the owner of the invoice |

|

|

Creation date, i.e. the date on which the invoice was received by Aruba Electronic Billing |

|

|

Date of last update |

|

|

SDI (Exchange System) ID |

|

|

true if the invoice and associated notifications have been saved (see getInvoicePdd for downloading the preservation package), otherwise _false _ |

|

|

Invoice channel |

|

|

Name of shop if invoice comes from ecommerce |

|

|

List of errors in the possible rejection notification |

|

|

Pdf file in Base64 format. |

|

|

Name of transferor provider |

|

|

Country code of transferor provider (e.g.) 'IT', 'DE' etc.) |

|

|

VAT number transferor provider |

|

|

Tax code transferor provider |

|

|

Name of transferee client |

|

|

Country code of transferee client (e.g. 'IT', 'DE' etc.) |

|

|

VAT number of transferee client |

|

|

Tax code of transferee client |

|

|

Invoice date |

|

|

Invoice number |

|

|

Total document |

|

|

Total Vat |

|

|

Net payable |

|

|

Document type |

|

|

|

|

|

Contains one of the messages in Asynchronous Checks if status is Errore Elaborazione, otherwise null |

8.4. getInvoiceZip

GET base url other methods/api/v2/invoices-out/zip

Returns an invoice with all of its notifications in Zip format (e.g. IT01879020517_abcde.xml.p7m). Search performed by invoice id, invoice filename or idSdi.

HTTP request

GET /api/v2/invoices-out/zip?filename=IT01879020517_jtlk1.xml.p7m HTTP/1.1

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=Request headers

| Name | Description |

|---|---|

|

Authorization Access token obtained by signin |

Request parameters

| Parameter | Description | Constraints |

|---|---|---|

|

File name of invoice |

Mandatory if neither id nor idSdi are specified |

|

Invoice Id |

Mandatory if neither idSdi nor filename are specified |

|

SdI Id |

Mandatory if neither id nor filename are specified |

HTTP response

HTTP/1.1 200 OK

Content-Disposition: attachment; filename="IT01879020517_jtlk1.xml.p7m.zip"

Content-Type: application/zip

Accept-Ranges: bytes

Content-Length: 8

<binary>8.5. getInvoicePdd

GET base url other methods/api/v2/invoices-out/pdd

If pddAvailable is true then this method retrieves the Preservation package as a Zip file of

a sent invoice, specifying its file name (filename), ID (id) or sdiId (idSdi).

If however pddAvailable is false, in other words, the Preservation package is not available,

the HTTP status code 404 is returned.

HTTP request

GET /api/v2/invoices-out/pdd?filename=IT01879020517_jtlk1.xml.p7m HTTP/1.1

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=Request headers

| Name | Description |

|---|---|

|

Authorization Access token obtained by signin |

Request parameters

| Parameter | Description | Constraints |

|---|---|---|

|

File name of invoice |

Mandatory if neither id nor idSdi are specified |

|

Invoice Id |

Mandatory if neither idSdi nor filename are specified |

|

SdI Id |

Mandatory if neither id nor filename are specified |

HTTP response

HTTP/1.1 200 OK

Content-Disposition: attachment; filename="IT01879020517_jtlk1.conservazione.zip"

Content-Type: application/zip

Accept-Ranges: bytes

Content-Length: 8

<binary>9. Find Invoices Received

Methods of finding received invoices.

9.1. findInvoices

GET base url other methods/api/v2/invoices-in

Finds a list of invoices. Returns invoices without content in base64 (lazy loading)

HTTP request

GET /api/v2/invoices-in HTTP/1.1

Accept: application/json

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=Request headers

| Name | Description |

|---|---|

|

Authorization Access token obtained by signin |

Request parameters

| Parameter | Description | Constraints |

|---|---|---|

|

page requested (default 1) |

Between 1 and totalPages |

|

Page size (default 10) |

Between 1 and 100 |

|

Invoice creation date (from) |

Mandatory, in ISO 8601 format, the difference with creationEndDate cannot be more than 2 days |

|

Invoice creation date (to) |

Mandatory, in ISO 8601 format, the difference with creationStartDate cannot be more than 2 days |

|

Country Code of the assignor/provider |

|

|

VAT number of the assignor/provider |

|

|

Tax code of the assignor/provider |

|

|

Country Code of the assignee/customer |

Mandatory if the user is a Premium user |

|

VAT number of the assignee/customer |

Mandatory if the user is a Premium user |

|

Document type |

|

|

Last invoice modification date (from) |

In ISO 8601 format |

|

Last invoice modification date (to) |

In ISO 8601 format |

HTTP response

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: 3547

{

"content" : [ {

"invoices" : [ {

"invoiceDate" : "2025-05-20T09:42:58.029Z",

"number" : "2025/0001",

"documentType" : "TD01",

"totalDocument" : 100.0,

"totalVat" : 22.0,

"netPayable" : 100.0

} ],

"id" : "1",

"sender" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "22222222",

"fiscalCode" : "11111111111"

},

"receiver" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "4444444",

"fiscalCode" : "333333333"

},

"invoiceType" : "FPR12",

"docType" : "in",

"file" : null,

"filename" : "IT01879020517_jtlk0.xml.p7m",

"username" : "Utente",

"creationDate" : "2025-05-20T09:42:58.030+0000",

"lastUpdate" : "2025-05-20T09:42:58.030+0000",

"idSdi" : "11110",

"pddAvailable" : true

}, {

"invoices" : [ {

"invoiceDate" : "2025-05-20T09:42:58.030Z",

"number" : "2025/0002",

"documentType" : "TD01",

"totalDocument" : 100.0,

"totalVat" : 22.0,

"netPayable" : 100.0

} ],

"id" : "2",

"sender" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "22222222",

"fiscalCode" : "11111111111"

},

"receiver" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "4444444",

"fiscalCode" : "333333333"

},

"invoiceType" : "FPR12",

"docType" : "in",

"file" : null,

"filename" : "IT01879020517_jtlk1.xml.p7m",

"username" : "Utente",

"creationDate" : "2025-05-20T09:42:58.031+0000",

"lastUpdate" : "2025-05-20T09:42:58.031+0000",

"idSdi" : "11111",

"pddAvailable" : true

}, {

"invoices" : [ {

"invoiceDate" : "2025-05-20T09:42:58.031Z",

"number" : "2025/0003",

"documentType" : "TD01",

"totalDocument" : 100.0,

"totalVat" : 22.0,

"netPayable" : 100.0

} ],

"id" : "3",

"sender" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "22222222",

"fiscalCode" : "11111111111"

},

"receiver" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "4444444",

"fiscalCode" : "333333333"

},

"invoiceType" : "FPR12",

"docType" : "in",

"file" : null,

"filename" : "IT01879020517_jtlk2.xml.p7m",

"username" : "Utente",

"creationDate" : "2025-05-20T09:42:58.031+0000",

"lastUpdate" : "2025-05-20T09:42:58.031+0000",

"idSdi" : "11112",

"pddAvailable" : true

}, {

"invoices" : [ {

"invoiceDate" : "2025-05-20T09:42:58.031Z",

"number" : "2025/0004",

"documentType" : "TD01",

"totalDocument" : 100.0,

"totalVat" : 22.0,

"netPayable" : 100.0

} ],

"id" : "4",

"sender" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "22222222",

"fiscalCode" : "11111111111"

},

"receiver" : {

"description" : "Aruba SPA",

"countryCode" : "IT",

"vatCode" : "4444444",

"fiscalCode" : "333333333"

},

"invoiceType" : "FPR12",

"docType" : "in",

"file" : null,

"filename" : "IT01879020517_jtlk3.xml.p7m",

"username" : "Utente",

"creationDate" : "2025-05-20T09:42:58.031+0000",

"lastUpdate" : "2025-05-20T09:42:58.031+0000",

"idSdi" : "11113",

"pddAvailable" : true

} ],

"first" : true,

"last" : true,

"totalElements" : 4,

"totalPages" : 1,

"size" : 10,

"number" : 1,

"numberOfElements" : 4

}Response fields

| Field | Type | Description |

|---|---|---|

|

|

Array of invoices found |

|

|

true if the page found is the last, otherwise false |

|

|

Total number of invoices found |

|

|

Total number of pages |

|

|

Page size |

|

|

Current page number |

|

|

true if the page found is the first, otherwise false |

|

|

Number of elements returned |

|

|

Array of individual invoices in the batch |

|

|

Invoice ID |

|

|

Company sender |

|

|

Company receiver |

|

|

Transmission format (e.g. 'FPA12' or 'FPR12', etc.) |

|

|

out for sent invoice, in for received invoice |

|

|

File in Base64 format |

|

|

Filename (es. IT01879020517_abcde.xml.p7m) |

|

|

Username of the owner of the invoice |

|

|

Creation date, i.e. the date on which the invoice was received by Aruba Electronic Billing |

|

|

Date of last update |

|

|

SDI (Exchange System) ID |

|

|

true if the invoice and associated notifications have been saved (see pdd for downloading the preservation package), otherwise false |

|

|

Name of transferor provider |

|

|

Country code of transferor provider (e.g.) 'IT', 'DE' etc.) |

|

|

VAT number transferor provider |

|

|

Tax code transferor provider |

|

|

Name of transferee client |

|

|

Country code of transferee client (e.g. 'IT', 'DE' etc.) |

|

|

VAT number of transferee client |

|

|

Tax code of transferee client |

|

|

Invoice date |

|

|

Invoice number |

|

|

Total document |

|

|

Total Vat |

|

|

Net payable |

|

|

Document type |

9.2. getInvoiceDetail

GET base url other methods/api/v2/invoices-in/detail

Finds for an individual invoice by filename, invoice filename or idSdi(e.g. IT01879020517_abcde.xml.p7m).

HTTP request

GET /api/v2/invoices-in/detail?id=1 HTTP/1.1

Accept: application/json

Authorization: Bearer NLOGDVXLVaF3tzmnVPkTwpkuh7dG0i09uSCcog3u+rE=Request headers

| Name | Description |

|---|---|

|

Authorization Access token obtained by signin |

Request parameters

| Parameter | Description | Constraints |

|---|---|---|

|

Invoice Id |

Mandatory if neither idSdi nor filename are specified |

|

File name of invoice |

Mandatory if neither id nor idSdi are specified |

|

SdI Id |

Mandatory if neither id nor filename are specified |

|

If value is true, |

Not required. Default value is false |

|

If value is false, |

Not required. Default value is true |

|

If value is true, |

Not required. Default value is false |

HTTP response

HTTP/1.1 200 OK

Content-Type: application/json;charset=UTF-8

Content-Length: 896

{

"invoices" : [ {